Hi Everyone and welcome to Smart Business Lending Community

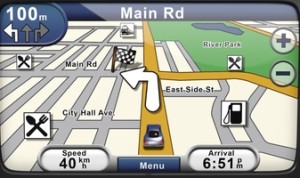

I would like to introduce you to a revolutionary new approach to business lending. We call it the GPS of business lending, because getting access to the capital you need with the right structure can be more challenging than you think.

Our story.

Over the past 30 years, I have been involved in hundreds of financing deals and, over time, I began to notice trends.

First, bankers have their own language and although I’m a CPA and understood the technical definition of various financial terms, I had to learn how they were using the terms in the context of the lending transaction.

Second, the process was a black hole… I

- Met with the loan officer

- Submitted tax returns and financials

- Answered many questions

- Eventually, received a proposal or a term sheet….

Third, I questioned if I was getting everything that I should get out of the lending transaction and should I be asking for something else. I felt like I had no control over the process, like driving a car without a steering wheel

This is what I call the communication gap.

I quickly realized that if I looked at a business and it’s financials from a banker’s perspective…I eliminated the communication gap. Also, asking the right questions of the lender opened up more opportunities for a better lending structure.

Over time…it became a routine of…

- Access to capital

- Incredible lending structures and

- Controlled risk

This is a winning situation for both the business and the lender….a true win/win situation.

Why should you care?

We want you to also have 1.) Access to capital you need, 2.) Incredible lending structures and 3.) Controlled risk. We’ve built a huge inventory of Excel models that have served as tools to breaking down the communication gap and creating transparency. Now, we want to share these Excel models, along with the knowledge and logic behind these models, with the you to create transparency and a “Smart Business Lending Community”, we call it… The GPS of business lending opportunities.

So what are we doing here?

Your time is valuable. Searching the web for information or seeking information from friends and colleagues may be helpful, but then you have to translate it into an effective communication tool, this is time consuming. smartbusinesslendingcommunity.com is the only place for, not only the information about these lending topics, but also the Excel worksheets you can download and execute immediately.

So join now and become a member….it’s free.

What’s in it for you as a member?

As a member… you get 3 things…

- Articles and videos on all the challenging lending topics

- Downloadable Excel worksheets you can immediately put to use

- A forum for you to ask us questions so you can get results particular to your situation

This is an exciting experience for you to take control of the business lending process with confidence and transparency. We’re really excited about bringing this value to the local business and lending community. This is not about lending on a national scale, this is about business lending transactions in Massachusetts. Local businesses working together with local banks…

Our Smart Business Lending Community