Understanding how your bank looks at a Debt Service Coverage (DSC) Ratio

In this article, we’re going to look at an overview of the debt service coverage ratio and understand how your bank looks at your financial statements

Why use a debt service coverage ratio?

Bankers need a way to measure a company’s performance in a way that assures them that the company makes enough money to pay its debts. Net income alone doesn’t accomplish this. Also, this measure needs to be able to be applied, regardless of the industry, a DSC ratio accomplishes this. Looking at the historical and forecasted DSC measures the risk of the company and allows the bank to compare it to their internal risk tolerance. We like to look at risk as having two components

- Probability – The probability that an event will happen and,

- Seriousness – The cost or dollar amount of loss if the event happens.

What is a debt service coverage ratio?

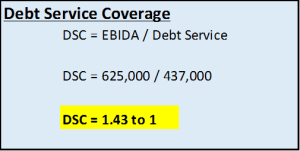

EBIDA is Earnings Before Interest, Depreciation and Amortization (sometimes referred to as cash flow or operational cash flow). Debt Service is principal and interest payments on all loans for a given twelve month period of time. Common DSC Ratios are 1.2 to 1, 1.3 to 1 and can be as high as 2.0 to 1. Given a debt service coverage ratio of 1.2 to 1, a company is making $1.20 of cash flow for every dollar of debt service. The DSC is usually measured annually but can be measured quarterly or using a rolling 4 quarters method. Now….let’s look at the definition of a DSC ratio.

- DSC is EBIDA/Debt service EBIDA is Earnings Before DSC = EBIDA/Debt service

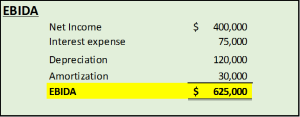

- EBIDA = Earnings Before Interest, Depreciation and Amortization (sometimes referred to as cash flow)

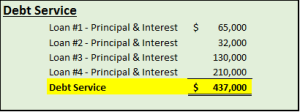

- Debt Service = Principal and interest payments on all loans for a given 12 month period of time.

Sample DSC Calculation

Let’s now look at a sample computation of EBIDA. In this example, we start with net income of $400,000, add back interest expense because this is a component of debt service. Add back depreciation and amortization because these are non-cash expense items, and we arrive at our EBIDA or cash flow of $625,000. Be aware that these computations can vary and are dictated by your loan documents. Some variations to this computation included subtracting distributions and subtracting unfunded capital expenditures.

Here, we have taken the same EBIDA calculation of $625,000 and now comparing it to debt service. If the company has four term loans with the annual debt service as indicated by this debt service schedule, the annual debt service totals $437,000. So the DSC ratio is the EBIDA of $625,000 compared to the debt service $437,000 or a ratio of 1.43 to 1 This means that the company generated 43% more cash flow from operations than was needed to service its debt.

43% more cash flow was generated by operations than was needed to pay term debt.

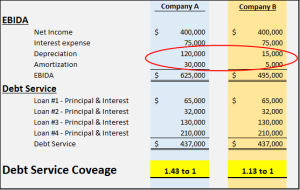

Why profitability alone is not good enough

Now we’ll take a look at why profitability alone is not a good measure of performance. Remember, a banks goal is to get assurance that the company makes enough money to pay its debts. In this example, Company A has the net income, EBIDA, and debt service we described in our earlier examples. Company B has the same net income and debt service as company A but the EBIDA is different because the depreciation and amortization deductions in arriving at net income are different. So Company B has a net income of $400,000 but only has an EBIDA or cash flow of $495,000. When you compare this to the debt service of $437,000, the DSC is only 1.13 to 1. If Company B had a DSC requirement of 1.2 to 1 or better in its loan documents, the company would be in default and a default on the DSC is no different than a default in payment. So as you can see, two identical companies with the same net income and same debt service do not produce the same EBIDA or DSC ratio.

Some final thoughts on DSC and talking to your lender.

We’d like to leave you with some final thoughts about your DSC ratio and talking to your bank. Know the details of your DSC ratio requirements, you can find this in your loan documents. There is no standard requirement or standard calculation among banks, they have the liberty to vary these for each situation. And realize that some variations can be more restrictive to a company’s growth

Be Proactive with your lending relationship

The best way to manage your banking relationship is to be proactive. Know you DSC history better than your lender. Also, know your DSC ratio on all forecasted and budget information that you submit to the bank. Be aware that a good DSC ratio does not mean that you have enough cash. Some common causes of a decrease in cash that don’t affect EBIDA and the DSC ratio are Increases in Accounts receivable, increases in inventory and decreases in Accounts Payable. The inverse can also happen, you can have enough cash because of decreases in accounts receivable and inventory or an increase in accounts payable and still be failing your DSC ratio.

The Delta Group Value

At the Delta Group, we add value by finding the right debt structure that matches your business model and strategy, optimizing your cash flow strategy and cash availability. We also add value by building strong relationships with your bank, knowing what options are available in the banking marketplace so you get the best cash flow options available. We do this by knowing your company’s DSC history and forecast as well as the banks sensitivity to your business model, strategy and the effects on DSC. Also, knowing the other financial requirements, in addition to DSC, that the bank is sensitive to and communicating that management has an understanding and focus on achieving these financial requirements. Transparency, showing and explaining to the bank the math behind your business model and strategy and how it affects the DSC and other financial requirements as well as the effect on the bank’s perception of risk It’s all about value…..and bringing discipline to your vision.

Leo J. Correia, CPA

CFO Partner

lcorreia@thedeltagroupllc.com

Mobile: 978-895-1759